With the turn into the new quarter on Apr. 1, normally IBES by Refinitiv provides the “bottom-up” quarterly estimates for what is calendar 2022, however they did not provide that data on either Apr. 1 or Apr. 2, last week, so hence the “ish” on the new forward 4-quarter estimate.

The new 4-quarter estimate measures the period now from Q2 ’21 to Q1 ’22.

Once IBES provides the bottom-up quarterly EPS estimates for next year, 2022, we’ll know the exact figure.

The $180 ‘ish number is probably too low since the “normal” dollar increase as we roll into the new quarter approximates a $5 – $6 increase typically, so that should put the exact figure once we know it between $180 – $181.

Once the 2022 bottom-up quarterly estimates are posted, this blog will be updated.

Still good news

Q1-Q2 2021 Forward EPS Revenue Growth Rates

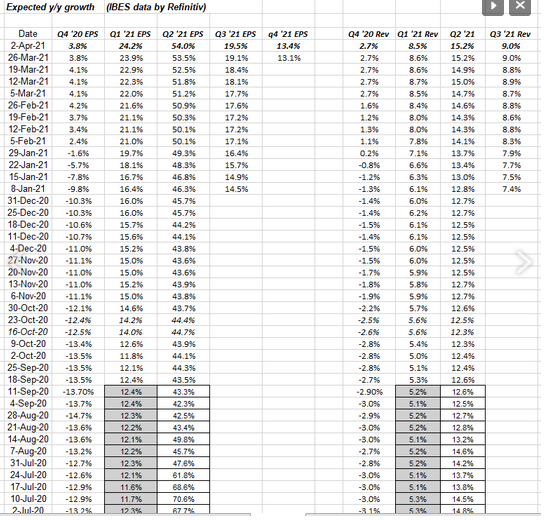

This spreadsheet, which was created from the IBES by Refinitiv data, shows the forward quarters “expected” EPS and revenue growth rates for the SP tracked on a weekly basis.

While revenue growth has stalled for now, the EPS revisions continue to be revised higher for forward quarters in 2021.

As Martha would say “that’s a good thing.”

Q4 ’20 will fall off next week, and Q4 ’21 will be added to in forward weeks.

Note how Q1 ’21 “expected” SP 500 EPS and revenue growth rates have jumped from 12% as of last summer to 24% currently (EPS) while revenue has increased from 5.3% last summer to 8% currently.

Two more interesting stats

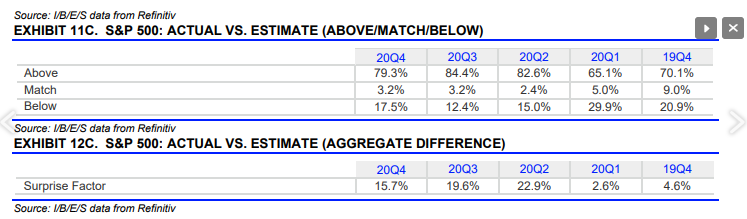

While I wanted to show readers the “upside surprise” factor in SP 500 EPS earnings (section 12C) by quarter since the pandemic struck, it was also worth showing the “beat rates” for the entire quarters as well. (Section 11C).

The sell-side analyst community has dramatically underestimated the strength of SP 500 earnings since the pandemic struck.

It’s really been the case since the 2008 Financial Crisis too. Analysts are people too and when you live through brutal bear markets, it leaves a mark.

Summary/conclusion

Interesting comment by Blackrock’s Rick Rieder on his monthly bond market conference call held Thursday morning, Apr. 1 at 7 am central. Rick noted that fully 1/3rd of the money in circulation today has been created after March 2020, or after the pandemic. That gives you some idea of the amount of monetary stimulus Fed Chair Jerome Powell threw at the US economy beginning in April ’20, and that doesn’t include the fiscal stimulus still being played out.

Looking at the first attached spreadsheet, the upward revisions to SP 500 EPS expected growth rates is a plus, but I wonder how long that lasts with tax hikes.

President Joseph Biden has said that no American making less than $400,000 will see higher personal income tax rates (although another article said that has been revised lower to $200,000), but every American with a 401k plan, regardless of their salary, will see some impact in the corporate tax rate since a lot of that money is “indexed” investments and an increase in the corporate tax rate will see a reduction in SP 500 EPS estimates.

For example the current 2020 SP 500 EPS estimate is roughly $200 per share. Let’s use round numbers to make the example readable and understandable. If the SP 500 has an effective tax rate of 20% and that is increased to 30%, then logic would have to assume that the new estimate for the SP 500 EPS in 2022 would be $180 or a 10% reduction.

The question for us (this post and readers) is would a 10% reduction in SP 500 EPS from a higher effective tax rate for the SP 500 cause a material drop in the SP 500, even as just an adjustment? It would certainly mean a higher PE ratio. Closing at 4,019 on Friday, Apr. 1, the SP 500 was trading at 20x the 2022 estimate of $200 in EPS, but 22x at a $180 estimate.

This is very quick back-of-the-envelope math, and more work needs to be done.

Maybe a higher effective corporate tax rate means nothing, but when the TC&JA (Tax Cuts & Jobs Act) bill was signed in December, 2017, the SP 500 had risen 21.8% that year, and that was even with fed funds rate increases that started almost immediately after President Trump was elected in November ’16. (If memory serves, Janet Yellen put the first fed funds rate increase through in December ’16.)

The hard data will be published as soon as it comes down from IBES by Refinitiv on 2022 bottom-up EPS estimates for the SP 500.