Oracle (NYSE:) is the only company that reports this week that we follow with any frequency. The stock is up 60% YTD in calendar 2021. The sell-side consensus is looking for $0.97 on $9.77 billion for “expected” year-over-year growth of 4% respectively.

The Oracle “story” so to speak is that the operating margin was 48.5% in fiscal Q4 ’21, the highest gross margin since Q4, 2013, and the share repurchase activity has been sizable. In May ’18 or fiscal Q4 ’18, Oracle had 4.15 billion shares outstanding, and yet last quarter fully-diluted shares outstanding had fallen to 2.9 billion shares for a net removal of 1.25 billion shares or a quarter of ORCL’s fully diluted shares outstanding.

It would be interesting to compare Oracle’s share count reduction with the ’s ” Big 6″ or the top tech-weighted mega-caps in the S&P 500 today.

To compare, Oracle’s net income was a little over $4 billion in Q4 ’18 or May ’18, and the same net income number was $4.5 billion as of May ’21. Put another way, if we use the May ’18 share count for the May ’21 quarter, EPS would have been just $1.09 vs the $0.99 in Q4 ’18 16 quarters ago, on an “operational” basis, or roughly a 10% increase over 4 years or 2.5% per year, excluding share reduction impact.

L-T debt has increased from $56 billion in May ’18 to $76 billion as of May ’21. Do we need to wonder where that is going?

Frankly, I wished more of the stock had been bought for clients. Fundamentally, the cloud is as much a challenge for Oracle as it is an opportunity.

Dan Niles has been very right on the stock in 2021.

S&P 500 – by the numbers

- The forward 4-quarter estimate this week was $206.88 vs last week’s $206.75, versus the early June ’21 print of $191.52 15 weeks ago.

- The PE ratio on the forward estimate is 21.8x

- The S&P 500 earnings yield is 4.58% vs last week’s 4.56%.

- The “expected” Q3 ’21 bottom up EPS estimate today for the S&P 500 is $49.21. That estimate should increase to the mid $50’s by mid-November ’21 as Q3 ’21 earnings start to be reported.

The “growth rate” comparisons will get tougher for the S&P 500 as we move through late 2021, but there should continue to be an increase in “absolute” EPS/revenue as we move through the critical 4th quarter and into 2022.

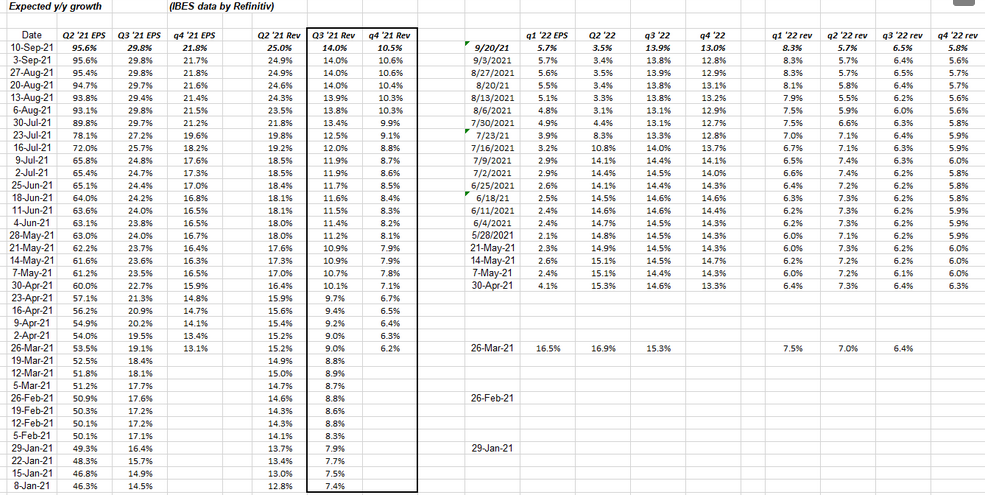

Here’s what the forward-quarter growth rates look like as of Friday, Sept. 10, 2021:

The data is sourced from IBES by Refintiv, but the spreadsheets are updated weekly to give readers a longer perspective on the trends.

Note how Q3 and Q4 ’21 expected S&P 500 revenue growth rates continue to slowly improve. 2022 is still a question mark, but the 2022 numbers should begin to change with Q3 ’21 earnings starting Oct. 10.

Summary/conclusion

Investors will see very little S&P 500 revision activity over the next 3 weeks. Large-cap earnings reports like , (NASDAQ:) and (NYSE:) will move the individual estimates, but the S&P 500 won’t likely see much revision changes until Q3 ’21 earnings start.

Unless an unexpected spate of “downside EPS surprises” hits the tape, the next few weeks should be quiet on the earnings and revisions front.

Remember take all this with healthy skepticism. Invest your own money based on your financial profile and your appetite for risk.