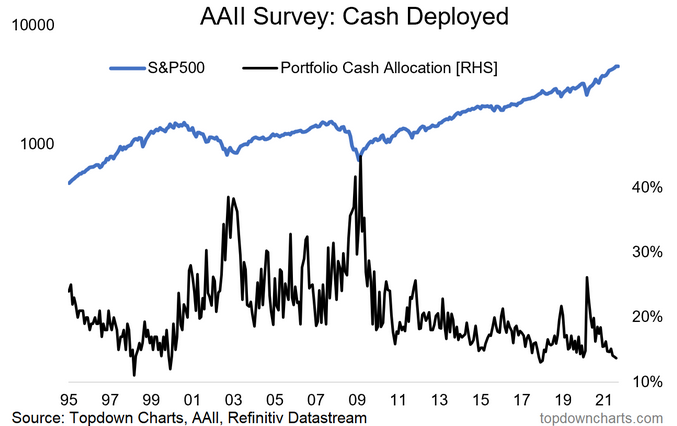

The August round of the AAII Asset Allocation Survey showed investor portfolio allocations to cash dropping to the 5th lowest reading on record.

Part of this is completely natural and to be expected. However, part of it is also a sign of an aging market cycle and gradual but steady shift in the risk vs return outlook.

There is information in the actions of the crowd, so when cash allocations fall to the bottom of the range, the information is that investors are basically “all-in.”

Firstly, it’s important to acknowledge that cash allocations can fall simply by virtue of other assets rising. For instance, if the goes up a lot (like it has) that will drift portfolio allocations to equities higher (and cash as a residual: lower). As one part of the pie gets bigger, the others by comparison get smaller.

I would encourage people to consider this as an active allocation decision though.

Yes it is a passive outcome in that investors might not have done any actual buying or selling, but by allowing allocations to cash to be drifted lower, investors are effectively making an active decision to let it happen.

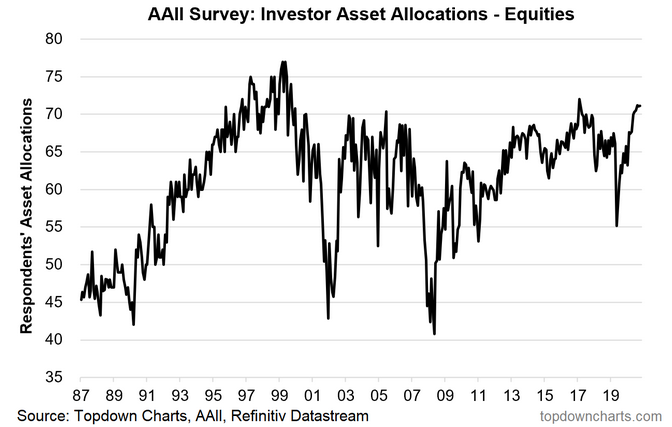

This brings us to the next chart which adds some important context and answered what I think would be a fairly obvious follow-up question:

The chart above shows allocations to equities from the same survey, interestingly it’s “only“ the 25th highest reading on record (vs 5th lowest for cash). Clearly though this is still very much at significant levels, and the last time it got to these levels it spelled the end of a near-uninterrupted cyclical bull market run and the arrival of significantly higher volatility.

So we can look at these charts as basically a sign that risks are rising: i.e. that the market cycle is well-progressed, and that investors are increasingly all-in.

One pushback of course is that equity allocations were higher during the dot com bubble: so maybe there is scope for investors to go …“more-in“?

Another possible pushback is that cash really is trash when interest rates are at zero and inflation is surging (and thus real returns on cash are significantly negative).

Indeed, investors who went all-in equities and shunned cash have not been wrong.

Another point is that this is only one piece of data. And I would definitely concede, it is only one piece of data …and I’m yet to find that golden chalice of an indicator that is omnipotent and infallible.

Luckily though we can look at a whole zoo of other indicators and information. And when we do so we find valuations at increasingly expensive levels, monetary policy turning the corner, and a selection of short-term risk flags waving too.

It is notoriously difficult to pick a market top, and frankly that’s out of scope of this blog post, but it’s very clear and easy to say that the risk vs return outlook has shifted.

Many of the conditions that existed in March/April 2020 that made it a have flipped in the opposite direction. So I don’t think cash is trash—it has a role to play in active asset allocation, and arguably the value of that role is rising as the balance of risks evolve.

Bottom Line: Investor portfolio allocations to cash are near the lowest on record, paradoxically this arguably actually raises the value of cash.