Earnings at PNC Financial (NYSE:) suffered last year along with the entire financial sector. Net income before extraordinary items came in at $2.95B in 2020, down from $5.35 in 2019 for a 45% reduction. In our opinion, amid the biggest crisis since the Great Depression, the fact that PNC and its peers even managed to stay profitable is admirable.

Profit declines during a crisis are hardly surprising. What many didn’t expect, though, was the sharp surge in PNC Financial in the last three quarters of last year. The price briefly dipped below $80 a share in March 2020. Last week, it closed above $180. We are happy to say that to our regular readers that rally didn’t come out of the blue.

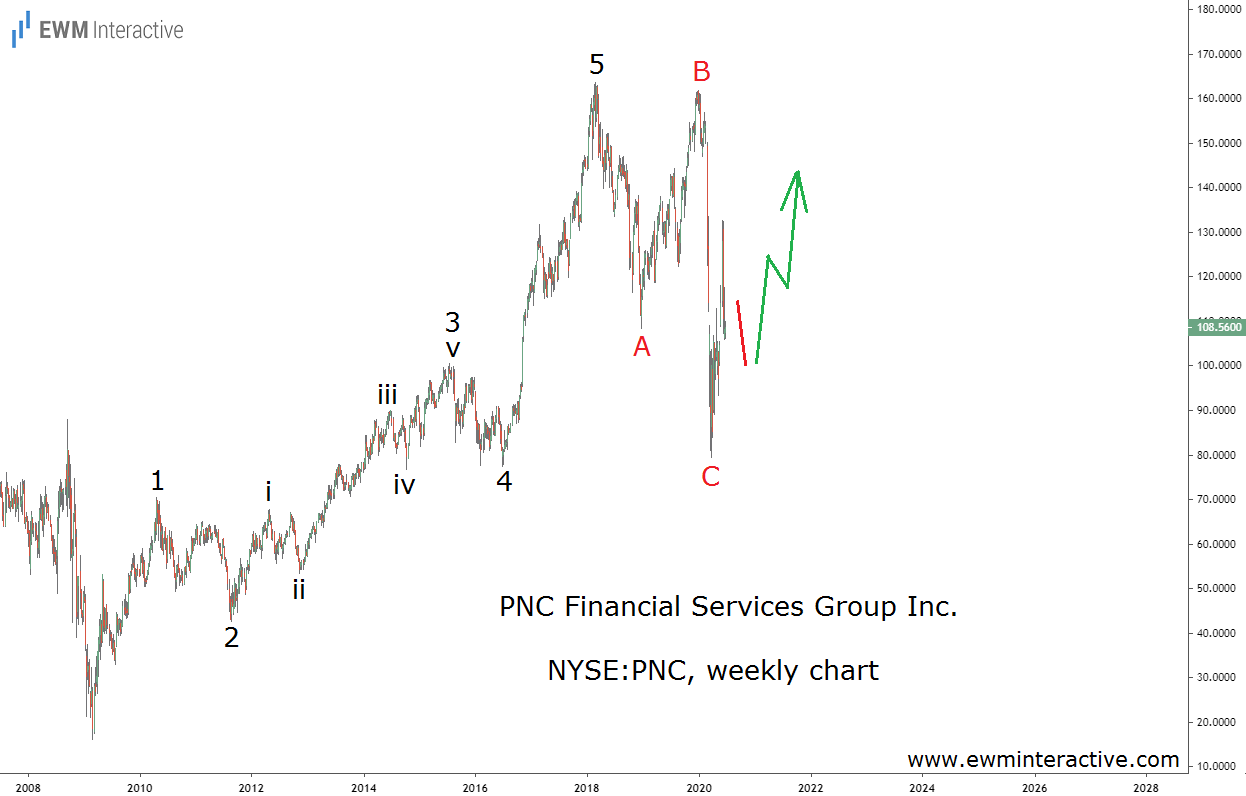

The chart above was on our website on June 23, 2020. It depicts a very clear bullish 5-3 Elliott Wave cycle starting from the 2009 bottom. The first phase of the cycle is a five-wave impulse pattern, labeled 1-2-3-4-5. The second was an A-B-C flat correction.

According to the theory, once a correction is over, the preceding trend resumes. That was the logic we relied on when we shared our bullish view on PNC Financial last summer. Instead of extrapolating the recent crash into the future, we thought it had significantly de-risked the stock. A buying opportunity presented itself.

Last month, PNC Financial climbed to $184, up 130% from last years’ low and 69% since we wrote about it. Now, assuming another impulse pattern is going to form, it looks like $200 a share is within reach. After that, however, another correction to ~$150 should be expected.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.