4.20% and 4.80% gains from Microsoft (NASDAQ:) and Google (NASDAQ:), respectively, were not enough to offset a late-day market sell-off. Despite their significant gains and 10% contribution to the , the market ended lower by half a percent.

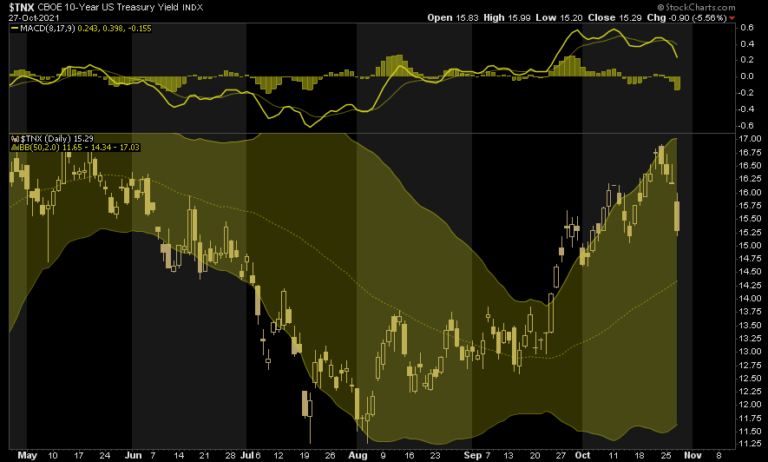

Bond yields fell sharply with the UST bond leading the way, down ten basis points. Economic data continues to show signs of weakening, yet the Fed is on the precipice of tapering QE. Might the bond market be warning us of a mistake in the making by the Fed?

What To Watch Today

Economy

- 8:30 a.m. ET: , week ended Oct. 23 (288,000 expected, 290,000 during prior week)

- 8:30 a.m. ET: , week ended Oct. 16 (2.420 million expected, 2.481 million during prior week)

- 8:30 a.m. ET: , quarter-over-quarter, Q3 first estimate annualized (2.6% expected, 6.7% in Q2)

- 8:30 a.m. ET: (PCE), Q3 first estimate (0.9% expected, 12.0% in Q2)

- 8:30 a.m. ET: , quarter-over-quarter, Q3 first estimate (4.5% expected, 6.1% in Q2)

- 10:00 a.m. ET: , September (0.5% expected, 8.1% in August)

- 11:00 a.m. ET: , October (20 expected, 22 in September)

Earnings Pre-Market

- 6:00 a.m. ET: (NYSE:) to report adjusted earnings of $2.48 per share on revenue of $4.25 billion

- 6:30 a.m. ET: (NYSE:) to report adjusted earnings of $1.55 per share on revenue of $12.32 billion

- 6:30 a.m. ET: (NYSE:) to report adjusted earnings of $2.20 per share on revenue of $11.84 billion

- 6:30 a.m. ET: (NYSE:) to report adjusted earnings of 36 cents per share on revenue of $871.13 million

- 6:45 a.m. ET: (NYSE:) to report adjusted earnings of $2.01 per share on revenue of $2.33 billion

- 7:00 a.m. ET: (NYSE:) to report adjusted earnings of $1.09 per share on revenue of $1.59 billion

- 7:00 a.m. ET: (NASDAQ:) to report adjusted earnings of 75 cents per share on revenue of $29.77 billion

- 7:00 a.m. ET: (NYSE:) to report adjusted earnings of $2.55 per share on revenue of $1.46 billion

- 7:00 a.m. ET: (NYSE:) to report adjusted earnings of $2.55 per share on revenue of $1.46 billion

- 7:00 a.m. ET: (NYSE:) to report adjusted earnings of $1.26 per share on revenue of $5.72 billion

- 8:00 a.m. ET: (NYSE:) to report adjusted earnings of $2.18 per share on revenue of $4.95 billion

Earnings Post-market

- 4:00 p.m. ET: (NASDAQ:) to report adjusted earnings of $13.24 per share on revenue of $111.81 billion

- 4:00 p.m. ET: (NASDAQ:) to report adjusted earnings of $2.46 per share on revenue of $5.06 billion

- 4:05 p.m. ET: (NASDAQ:) to report adjusted earnings of 99 cents per share on revenue of $8.20 billion

- 4:00 p.m. ET: (NASDAQ:) to report adjusted earnings of $1.77 per share on revenue of $6.27 billion

- 4:30 p.m. ET: (NASDAQ:) to report adjusted earnings of $1.24 per share on revenue of $84.69 billion

Courtesy of Yahoo

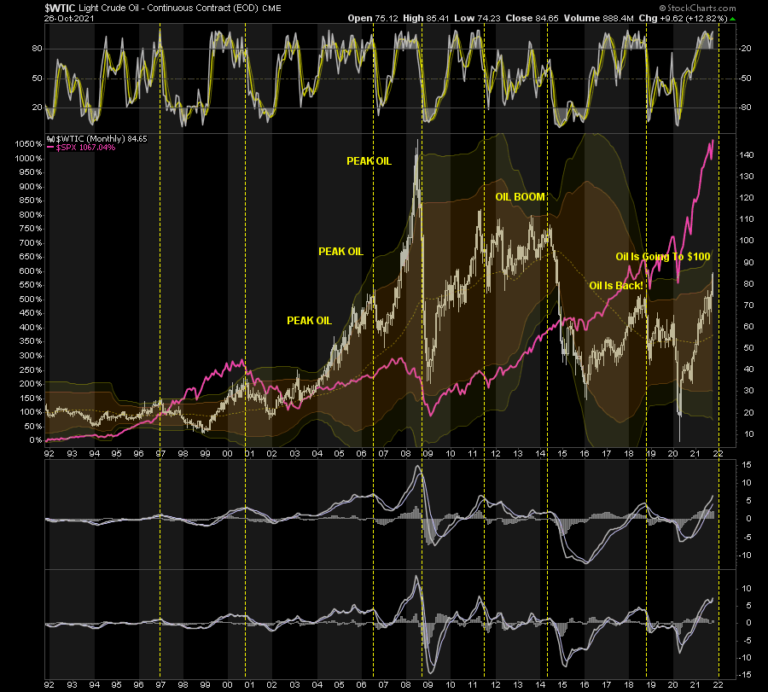

Taking Profits In Energy

The energy trade has gotten way ahead of itself currently. From a technical perspective, is now trading back at the same levels that preceded each of the last several major corrections. What will trigger that correction is unclear? However, it is worth noting there is a fairly high correlation to economic growth, which is weakening rapidly, and stock prices.

Based on that information, we took profits in our energy holdings yesterday and reduced positions back to target model weights.

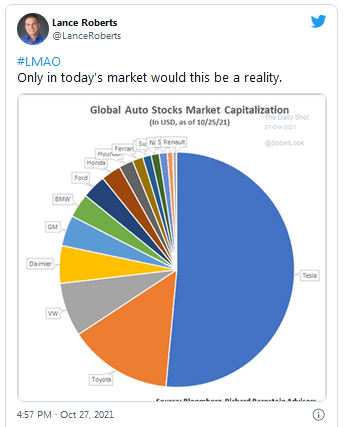

Tweet Of The Day

Tweet Of The Day

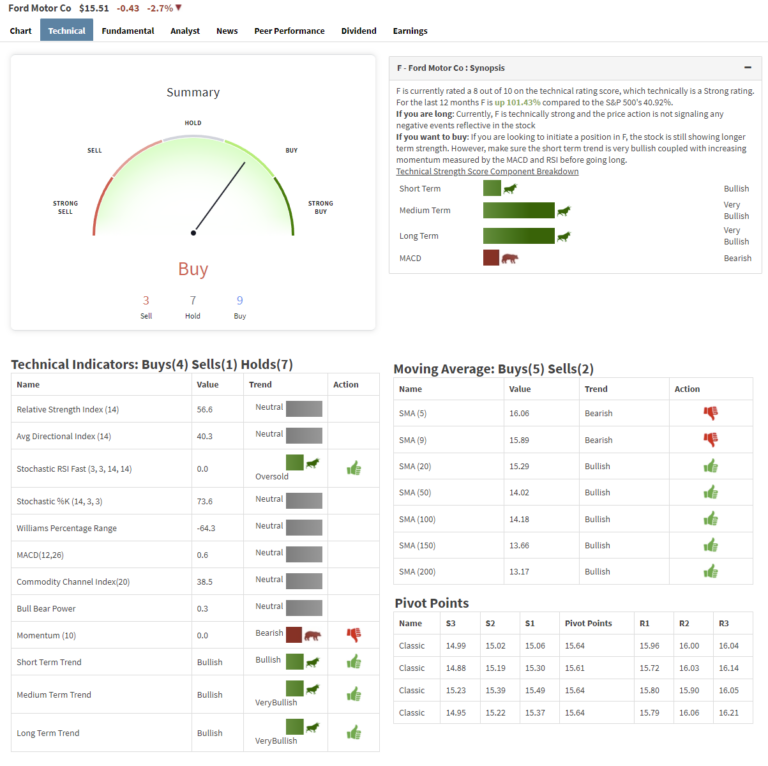

Ford Earnings

Ford Motor Company (NYSE:) crushed after the bell and the shares are up 10% this morning premarket. The company early doubled Wall Street’s earnings expectations and slightly beat revenue projections for the third quarter, leading the automaker to increase its annual guidance for the second time this year.

Here’s how Ford performed versus what Wall Street expected based on average analyst estimates compiled by Refinitiv.

- Adjusted EPS: 51 cents per share adjusted vs. 27 cents per share expected

- Automotive revenue: $33.21 billion vs. $32.54 billion expected

Importantly, one of the main reasons for our purchases initially, was the company would reinstate their dividend this year. That expectation became reality as ord said the fourth-quarter dividend of 10 cents per share on outstanding common and Class B stock will be paid on Dec. 1 to shareholders at the close of business on Nov. 19. We hold a 2.5% position in the Equity Model.

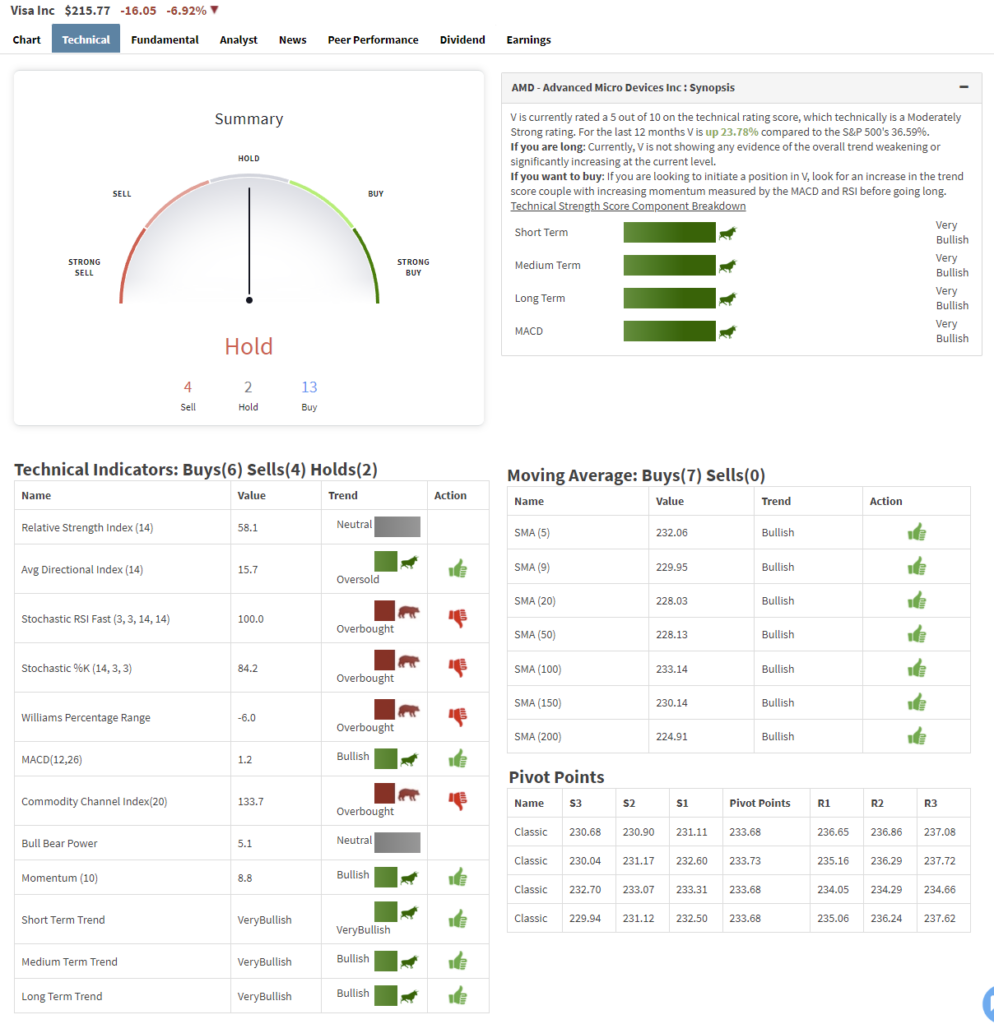

Visa Earnings

Visa (NYSE:) reported its fiscal yesterday after the close. GAAP EPS of $1.65 easily beat the consensus of $1.55. Revenue of $6.56B (+28.6% YoY) came in slightly above the consensus of $6.51B. Payments volume growth also topped estimates, coming in at +17% YoY versus expectations of +15% YoY. Cross-border payments volume rose +38% YoY versus expectations of +31.7% YoY; however, management’s outlook is not as rosy.

The CFO noted that revenue growth significantly depends on the pace of cross-border travel recovery, and V does not expect cross-border travel to reach 2019 levels until mid-2023. The outlook is weighing on performance as the stock closed down 6.92% in yesterday’s trading. We hold a 1% position in the Equity Model.

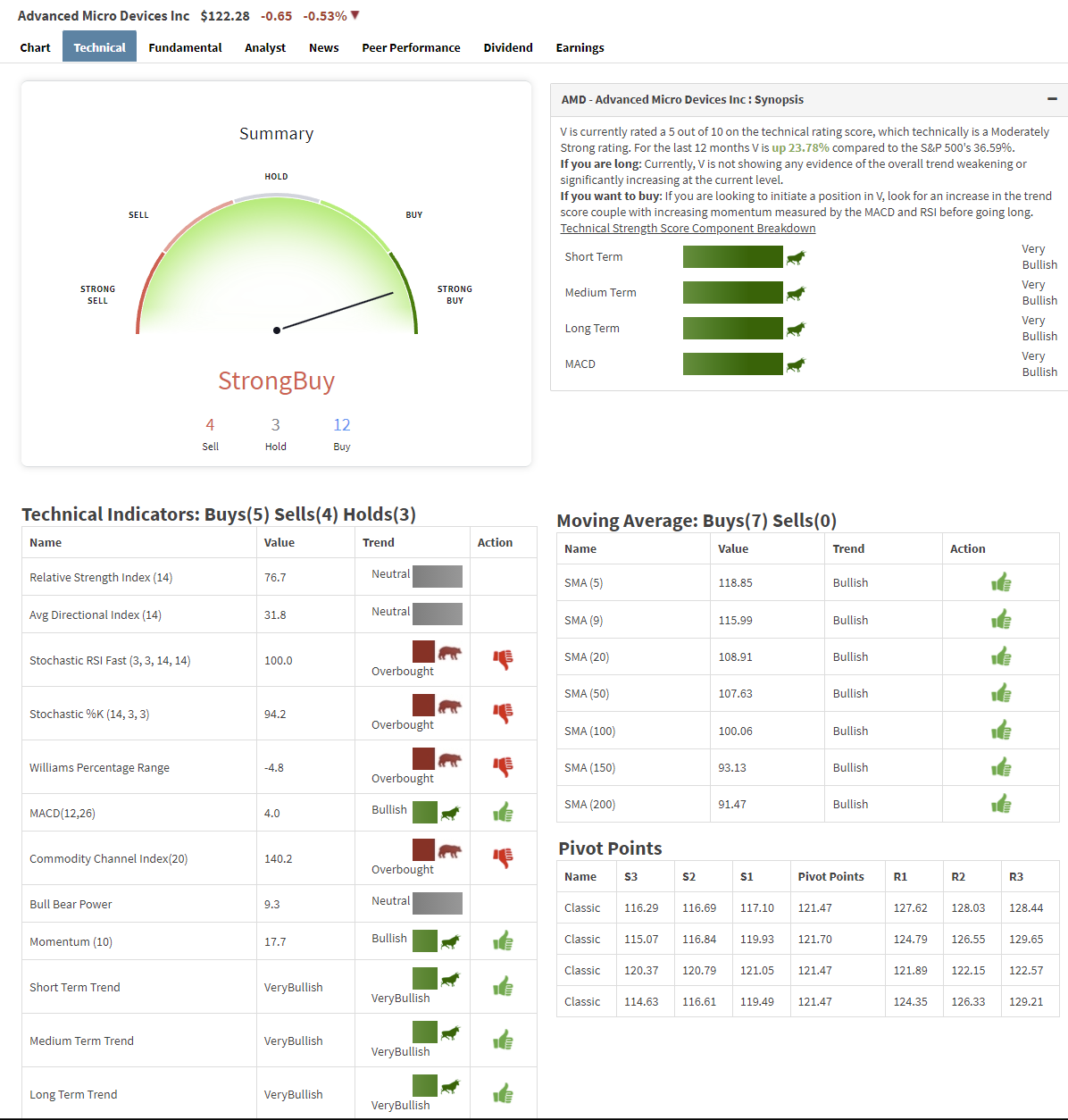

Advanced Micro Devices Earnings

Advanced Micro Devices (NASDAQ:) reported yesterday after the close. GAAP EPS of $0.75 beat the consensus of $0.61. Revenue also came in above consensus at $4.3B (+53.9% YoY) compared to expectations of $4.1B. According to the CEO, the growth is being driven by server chips, with data center sales more than doubling YoY.

Guidance for Q4 revenue was set to $4.4B-$4.6B, which blows analyst forecasts out of the water. As a result, management increased guidance for FY21 revenue growth to 65% from 60%. The stock is up 1.2% in mid-day trading. We hold a 2% position in the Equity Model.

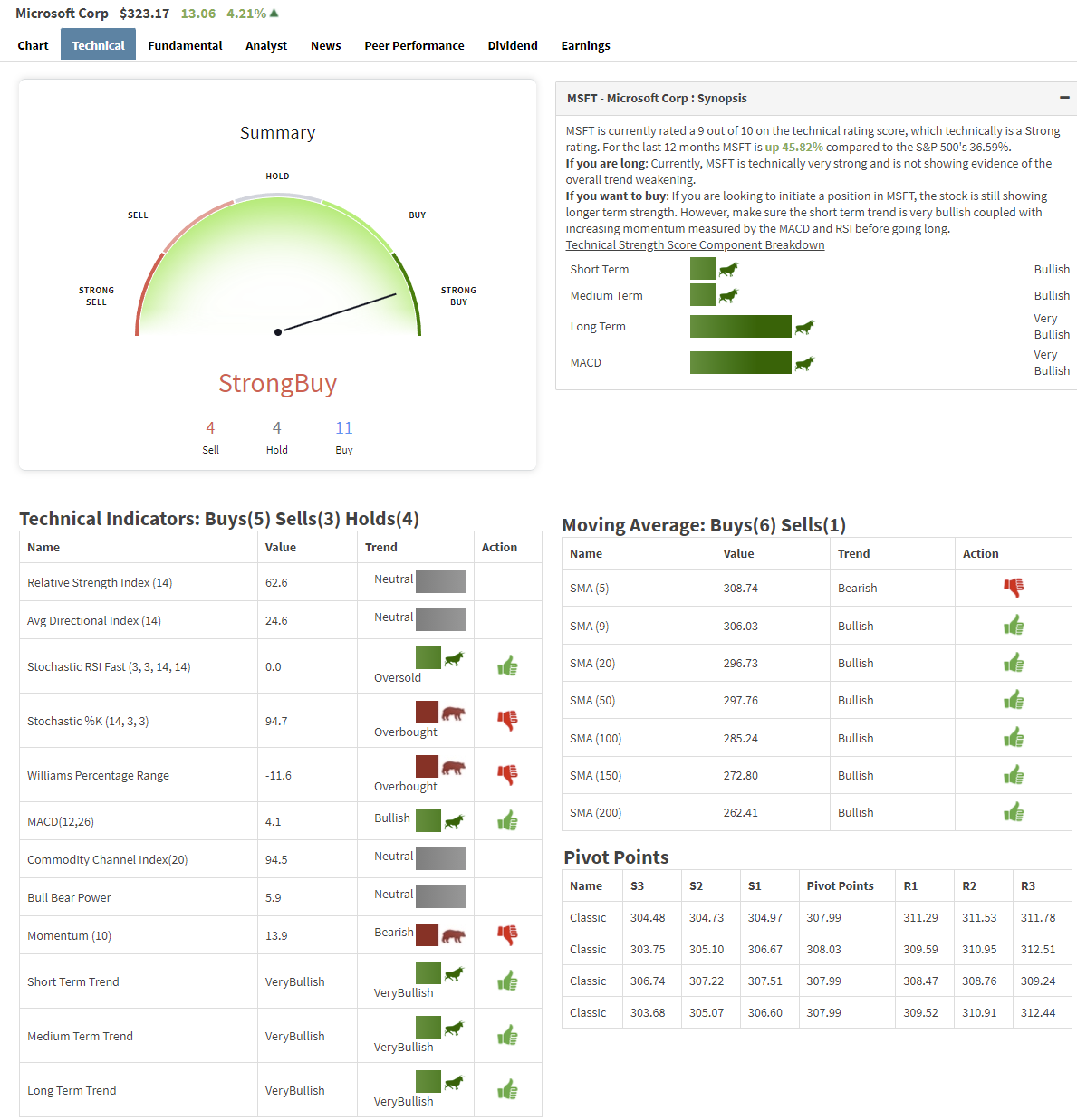

Microsoft Earnings

Microsoft reported its fiscal first-quarter earnings yesterday after the close. GAAP EPS was $2.71, which beat the consensus of $2.07. also came in above consensus, at $45.3B (+21.8% YoY) versus an expected $44B. The beat was driven by a 50% YoY increase in Azure and other cloud revenue.

Management offered guidance for Q2 revenue above the consensus at $50.15B-$51.05B versus estimates of $48.92B. The stock is traded 4.3% higher following the results. We hold a 2.5% position in the Equity Model.

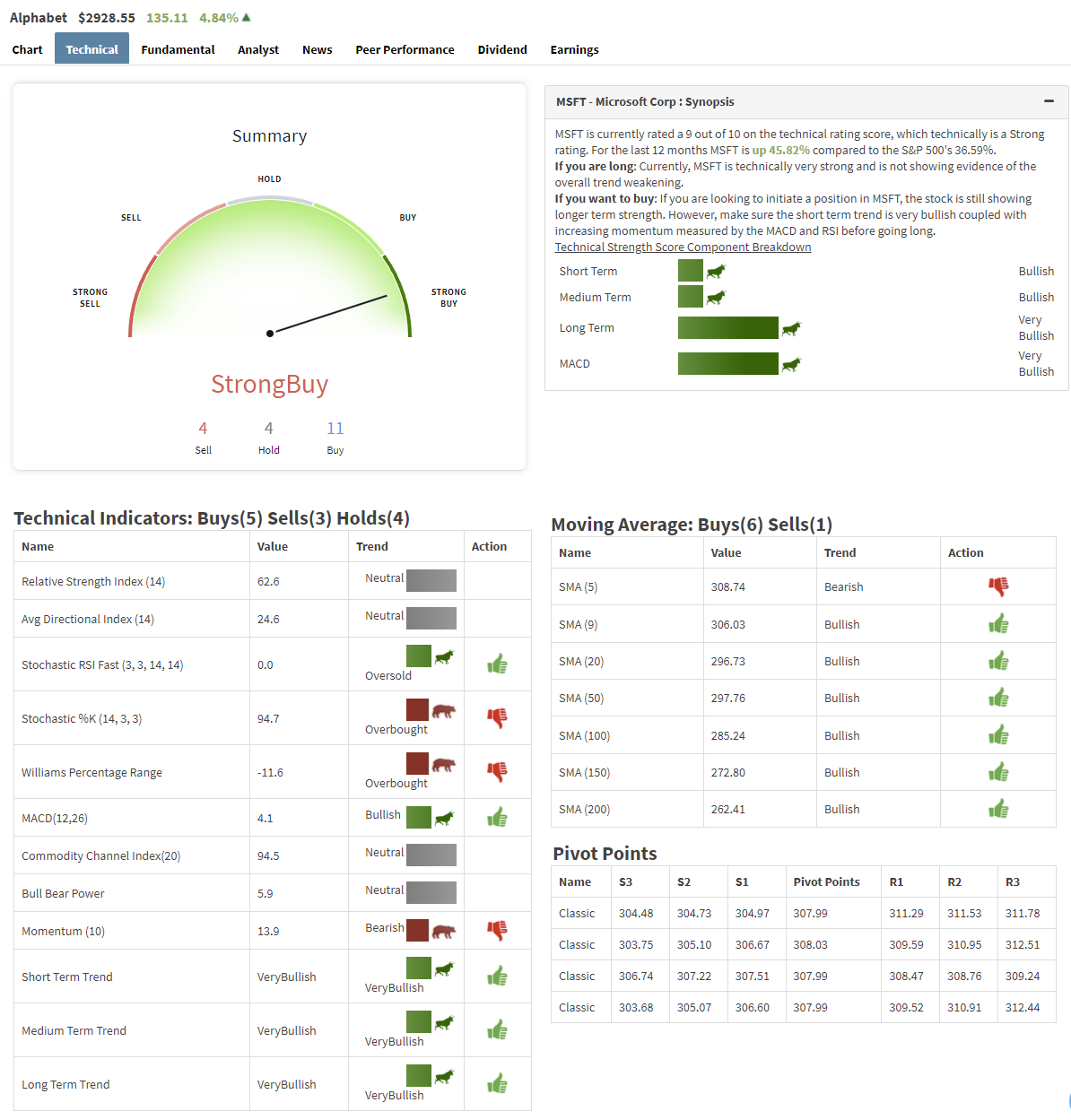

Alphabet Earnings

Alphabet Inc Class C (NASDAQ:) reported third-quarter earnings yesterday after the close. GAAP EPS of $27.99 topped the consensus of $23.32. Revenue of $65.1B (+41% YoY) also of $63.2B thanks to impressive advertising revenues. This was GOOG’s largest quarterly revenue gain in 14 years, and the growth led to an operating margin increase of 8%.

Management included a caveat with the impressive results, noting:

“Given the gradual recovery in results through the back half of 2020, the benefit from lapping prior year performance diminished in Q3 versus Q2 and will diminish further in Q4”.

The market’s reaction to the release was very bullish with the stock up 4.8% on the day. We hold a 2.5% position in the Equity Model.

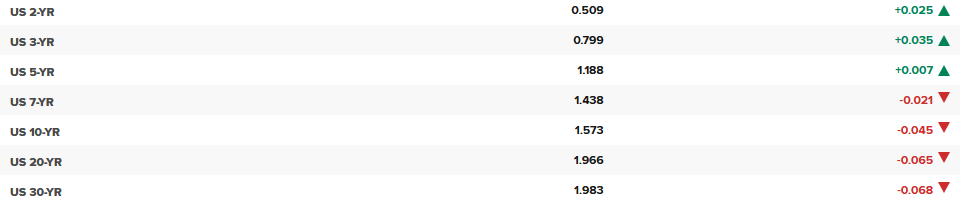

The Yield Curve Is Flattening

The table below shows the mid-day change in U.S. Treasury yields. Note the distinct flattening of the yield curve as short-term yields rise while long-term yields fall. For instance, 30-year bonds are down nearly 7 bps, while the note is up 3.5bps.

Bond traders are pricing in future Fed rate hikes, while at the same time understanding that tapering QE and rate hikes will slow growth and inflation, to the benefit of longer maturity bonds. The 20/30 year curve will most likely be the first part of the curve to invert. The yield difference between those two maturities is only 1.7bps.

Labor Market Tightness

Per Goldman Sachs: The Conference Board’s labor differential—the “difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—increased by 1.5pt to 45.0, the highest level since 2000.”

This data provides even more evidence there are more job openings than those looking for jobs. Again, another sign of a healthy labor market. A shortage of candidates provides employees leverage to demand higher wages. This doesn’t bode well for the profit margins of companies that rely on large labor forces.

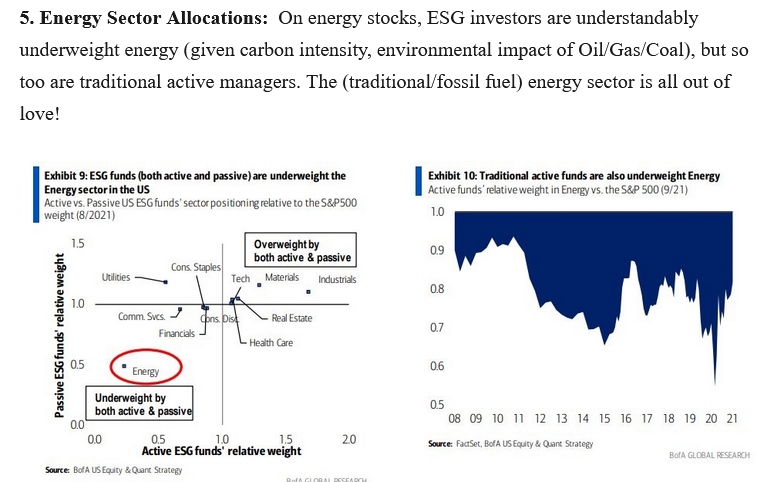

Energy Select Sector SPDR® Fund Is Neglected

The commentary and graphs below show that both ESG investors and traditional investors are underweighting the energy sector. Since January, XLE (NYSE:) (energy) is up 58%, almost triple the S&P 500 which is up 21%. If such outperformance continues, we suspect investors will eventually gravitate toward the energy sector and try to capture the outperformance. The graph and commentary is courtesy of Callum Thomas and @mikezaccardi