General Mills (NYSE:) is a major global packaged food producer. The past decade has not been kind to GIS investors or to the broader industry.

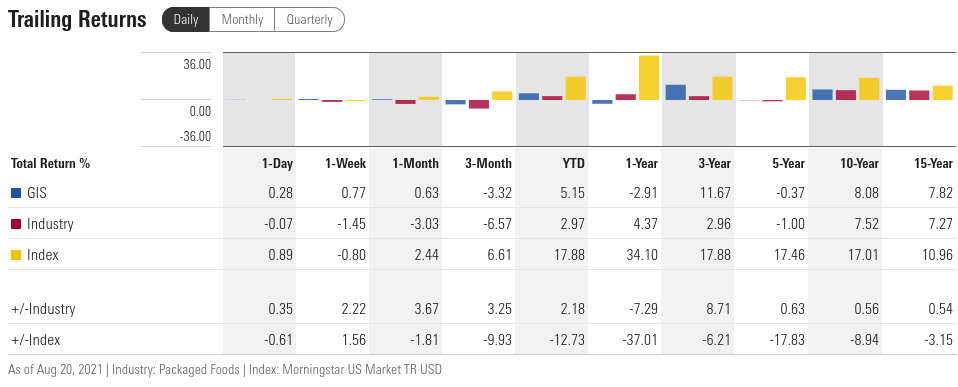

Over trailing 10 years, GIS and the Packaged Foods industry group have provided total returns that are less than half that of the U.S. equity market as a whole. The most recent five years are considerably worse, with negative total returns over a period during which the U.S. equity market has returned almost 17.5% per year.

A considerable portion of the underperformance is due to investors’ aggregate preference for growth over value stocks over the recent decade, but GIS has been growing revenue and earnings very over this same period.

Source: Morningstar

Price appreciation for General Mills is also constrained by the increasing fraction of money that is invested in index funds. GIS is a component of the Russell 1000 and the and has a beta (relative to the S&P 500) of about 0.4. As the S&P 500 rises, GIS will have decreasing weight in the major market-cap-weighted indexes relative to stocks with higher beta values.

GIS has a dividend yield of 3.39% and P/E of 15.96. GIS’s 5-year EPS growth rate is 6.34% per year, and the 5-year dividend growth rate is 2.3%.

The Gordon Growth Model (GGM) suggests that a reasonable expectation for the rate of return is the sum of the current yield and the expected dividend growth rate, which comes out to 5.7% for GIS if we use the trailing 5-year dividend growth rate as the expected value.

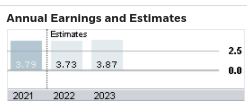

Consensus annual EPS expectations for GIS

Source: eTrade

The near-term outlook for General Mills’s earnings and revenue growth is poor. The consensus earnings outlook for GIS is for a 1.6% drop in earnings in FY 2022 and that FY 2023 EPS will be 2.1% higher than in 2021.

To formulate a view on GIS, I rely on two types of consensus outlooks. The first is the well-known Wall Street analyst consensus rating and 12-month price target. The second is the market-implied outlook derived from options prices.

Options prices represent traders’ aggregate outlook on the probability that the price of a stock will rise above (call option) or fall below (put option) a specific level (the strike price) between today and the option expiration date. By analysing options on GIS with a range of strike prices and a common expiration date, it is possible to calculate a probabilistic outlook for price returns that reconciles the options prices.

This is the market-implied outlook, representing the consensus implied by the aggregate of buyers and sellers of puts and calls on GIS. For those who are unfamiliar with market-implied outlooks, I have written an overview post with examples and links to the relevant financial literature. I have also written a substantial number of analyses using this approach.

Wall Street Consensus Outlook

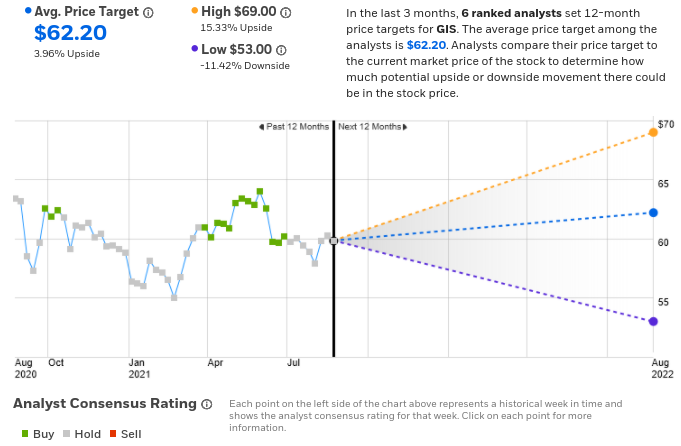

eTrade’s version of the Wall Street consensus is an aggregation of the ratings and 12-month price targets from 6 ranked analysts who have published their views within the past 90 days. The consensus rating is neutral and the 12-month price target is 3.96% above the current price. There is considerable dispersion across the analyst price targets, ranging from a low that is 11.4% below the current price to a high that is 15.3% above the current price.

Source: eTrade

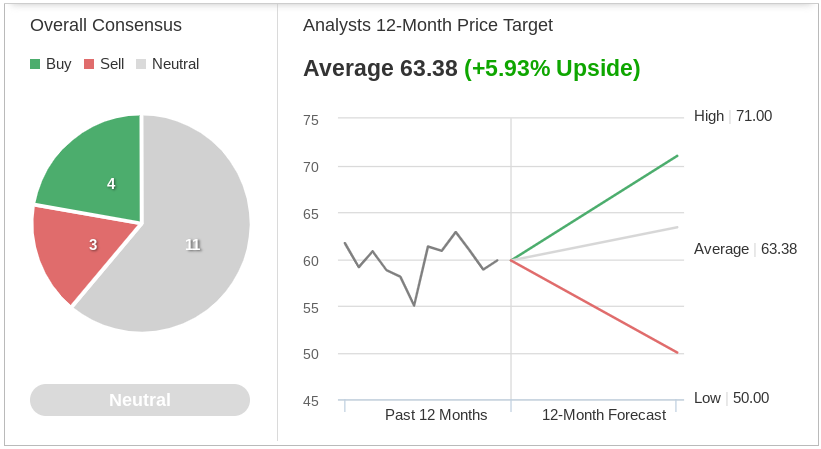

Investing.com’s Wall Street consensus outlook combines the views of 18 individual analysts. The consensus rating is neutral and the consensus 12-month price target is 5.93% above the current price.

Source: Investing.com

The Wall Street consensus 12-month price target predicts 4%-5.9% price appreciation over the next year. Adding the 3.4% dividend yield, the consensus for expected total return is 7.4%-9.3%.

There is a wide spread in the individual analyst price targets, however, which reduces confidence in the predictive value of the consensus.

Market-Implied Outlook

I have analyzed call and put options at a range of strike prices, all expiring on Jan. 21, 2022, to generate the market-implied outlook for the next 4.9 months, the period between today and the expiration date. I chose this expiration date to provide an outlook through the end of 2021 and because options expiring in January tend to be liquid.

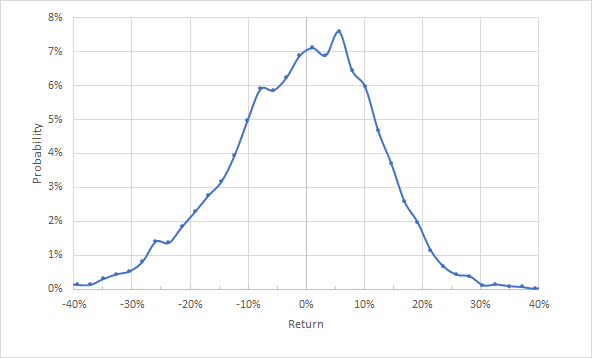

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal axis.

GIS: Market-implied probability, price return, today-Jan. 21, 2022

Source: author’s calculations using options quotes from eTrade

The market-implied outlook is generally symmetric, although there is a notable tilt in probabilities to favor positive price returns over the next 5 months or so. The peak probability corresponds to a price return of 5.6% over this period. Investors can expect to receive about $1.02 in dividends over this period, which brings the outlook for total return to 7.3% over 5 months.

The volatility calculated from this distribution is 13.4%, which can be annualized to 21%. The projected volatility is low for an individual stock, as expected given the low beta value for GIS.

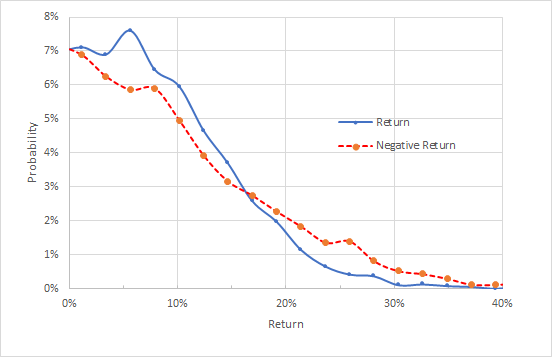

To make it easier to directly compare the probabilities of positive and negative returns of the same magnitude, I look at a version of the market-implied outlook for which I rotate the negative return side of the distribution about the vertical axis (below).

GIS: Market-implied probability, price return, today-Jan. 21, 2022

Source: author’s calculations using options quotes from eTrade

Note on the chart above: The negative return side of the distribution has been rotated about the vertical axis.

The probability of positive returns over the next 5 months is consistently higher than for similar-magnitude negative returns in the range from -15% to 15% (0% to 15% in the chart above). The probability of large negative returns is higher than for large positive returns of the same magnitude (15% and higher on the horizontal axis of the chart above).

These results are manifestations of negative skewness in the market-implied outlook. With a stock like GIS, investors have elevated chances of positive returns in exchange for taking on the chance of big negative surprises.

Having the peak probability at 5.6%, along with consistently elevated chances of positive returns for the most likely outcomes overall, is a bullish outlook for the next 5 months.

Summary

GIS has grown revenues and earnings slowly in recent years and the outlook is for continued sluggish growth.

The consensus outlook from Wall Street is neutral, with expected 12-month price appreciation in the range of 4%-6%, for expected total return of 7.4%-9.3%. The market-implied outlook into early 2022 is bullish, with elevated probability of positive price returns.

The annualized volatility derived from the market-implied outlook is 21%. For a stock to be attractive, I want to see an expected 12-month return for an individual stock that is at least half the expected volatility (e.g. 10.5% or higher expected total return for GIS), and GIS does not quite meet that criterion.

The bullish market-implied outlook suggests that GIS has a good chance of gaining ground through the end of the year and into early 2022, but the neutral analyst ratings and low earnings and dividend growth rates are concerns.

My overall rating on GIS is neutral.