As dividend yields and interest rates dropped in recent decades, income investors looked for ways to generate cash flow from stocks. Selling (“writing”) covered calls is one strategy that has gained attention.

It is certainly a conservative options strategy that most income investors think they should do. The math is compelling.

Here’s how it works. We would buy a dividend stock like Exxon Mobil (NYSE:) for its $0.87 per share quarterly payout (a 6% yield). Then we would write a covered call with a “strike” price just above the stock’s current level.

For example, XOM trades below $60 as I write. A call seller may peddle the October 15 expiring call with a $60 strike price. This would sacrifice upside above $60 but, in return, bring about $1.75 in cash. That’s roughly two dividend payments for a two-and-a-half-month commitment—not bad!

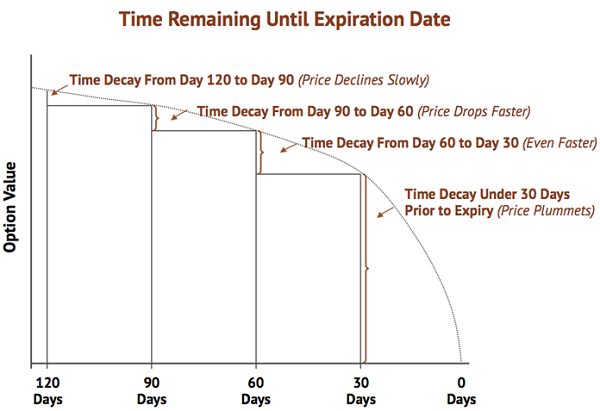

The secret is the short timeline. Time works against the option buyer, but for the option seller. Call options “decay” in price—move towards zero—as they approach expiration, dropping off a cliff in the final 30 days:

Option Time Decay Chart

This is a daunting chart for call buyers. Not only do they need the underlying stock to rise, but they need it to pop fast enough to outpace the option’s expiration!

It’s tricky enough to predict a stock price, and doing so within a set timeframe is, over time, an extremely tough strategy.

Which is why we income investors are attracted to selling (“writing”) covered calls. After all, if a kid on Robinhood (NASDAQ:) wants to overpay for a call option on XOM, why shouldn’t we be the ones to sell them that option and bank the premium ourselves?

To maximize decay in our favor we should be writing options at least monthly and preferably weekly. But I must admit—writing covered calls is boring. I’ve lost many hours of my otherwise entertaining life to this dull practice. I’m done with it—life is too short.

Instead, I prefer to take the easy (smart) way out and buy covered call funds. There are ETFs that will buy shares and write calls for income. But, as usual, the best deals in the space are found in covered call closed-end funds (CEFs).

Covered call strategies benefit from active management. You and I may not have the patience to grind out these payouts, but fortunately others do.

And we’re happy to pay their management fee if it gets comped for us. This is perhaps the best feature of CEFs. These vehicles often trade at discounts to their net asset values (NAVs).

This comes in handy when the NAV is comprised of blue-chip stocks. Nuveen Dow 30Sm (NYSE:) owns stocks like UnitedHealth (NYSE:), Goldman Sachs (NYSE:) and The Home Depot (NYSE:). Portfolio manager David Friar then writes covered calls on these stocks to generate additional income.

The result is a 6.4% dividend, which is quadruple the actual Dow 30’s current yield. And for whatever reason, DIAX trades at a 5% discount to its NAV. In other words, we can buy the Dow for 95 cents on the dollar and 4X the dividend yield.

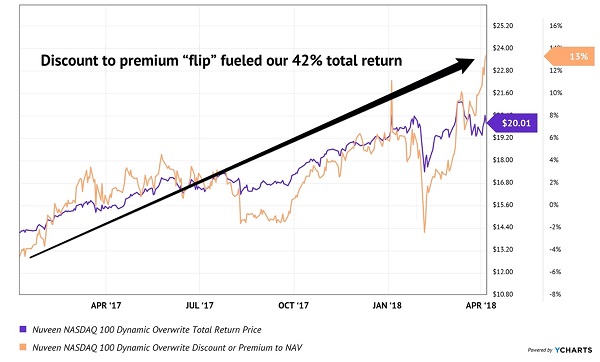

Sister fund Nuveen NASDAQ 100 Dynamic Overwrite Closed End Fund (NASDAQ:) is a payout play on the . Contrarian Income Report veterans will fondly remember our foray with QQQX. A few years back, we flipped the fund for 42% returns in just 15 months:

Bought Low (at Discount), Sold High (at Premium)

QQQX-2017 Trade Chart

QQQX-2017 Trade Chart

QQQX yields 6.1% today and trades at a slight 1% premium to its NAV today. I’d prefer to catch the fund at a discount after a market panic. That was the secret of our 2017 success—we were able to buy at a discount and sell at a premium. Buy low and sell high!

In CEF-land, it pays to be contrarian. Buy these funds when they are feared and flip ‘em when they glide back into favor.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”