This article was written exclusively for Investing.com

The second-quarter reporting period is nearing its end, and it has been far more robust than many expected. This has resulted in analysts’ boosting earnings estimates for the . However, with the index trading at its highest PE ratio in more than 20-years, everyone’s question should be: Was the quarter strong enough?

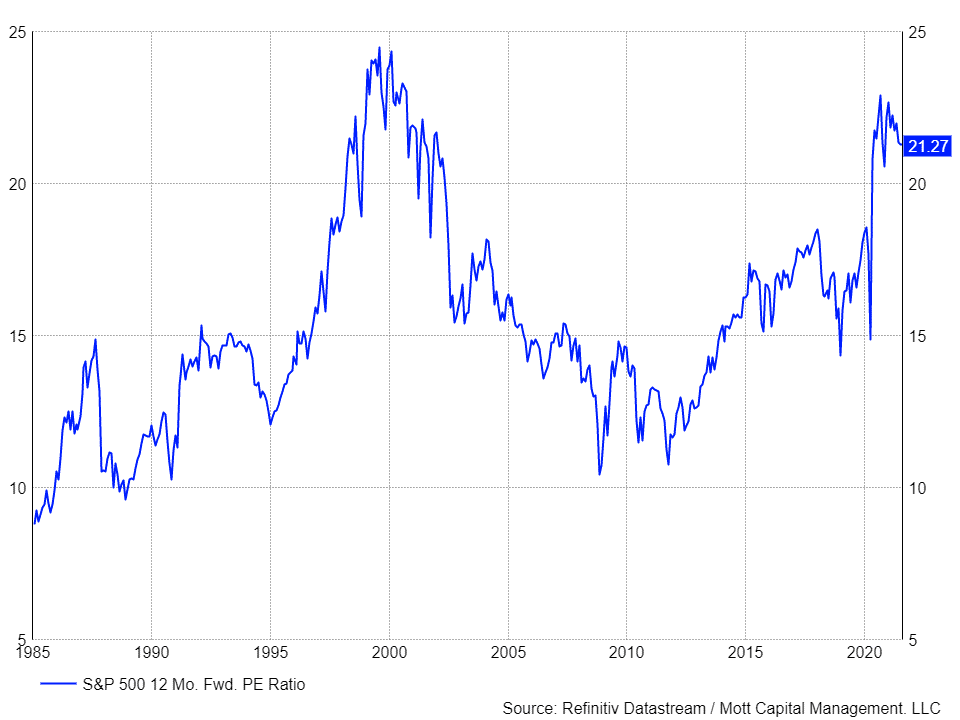

The S&P 500 is currently trading at 21.3 times its 12-month forward earnings estimates. This is an extremely high valuation only comparable to the late 1990s. The PE ratio to this point has been supported by a strong earnings growth rate and easy Fed monetary policy. However, as we advance, growth rates are expected to slow, and the Fed is likely to grow more hawkish as the US economy continues to recover.

High PE Ratio

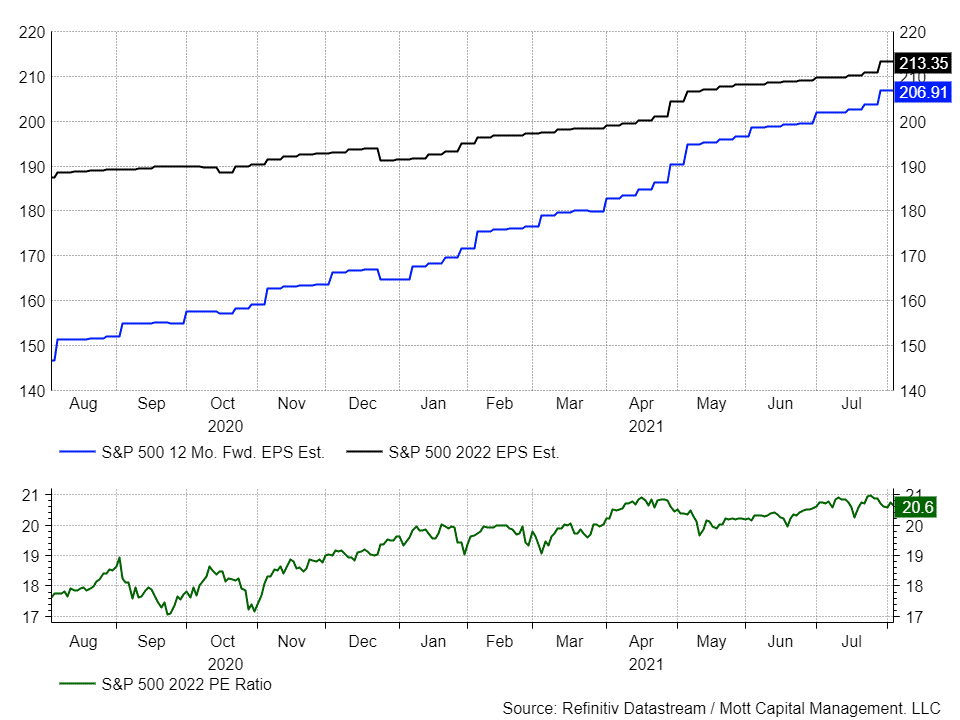

Earnings growth soared in 2021 as the US exited the lockdown phase of the coronavirus pandemic. This, coupled with easy monetary policy, helped the S&P 500 rise, expanding the PE ratio of the index. However, to this point, with earnings season nearly complete, revisions for earnings in 2022 have not been strong enough to help bring the PE ratio down to a level that is more reasonable and sustainable, such as a level seen pre-pandemic, in the mid-teens.

Not Strong Enough

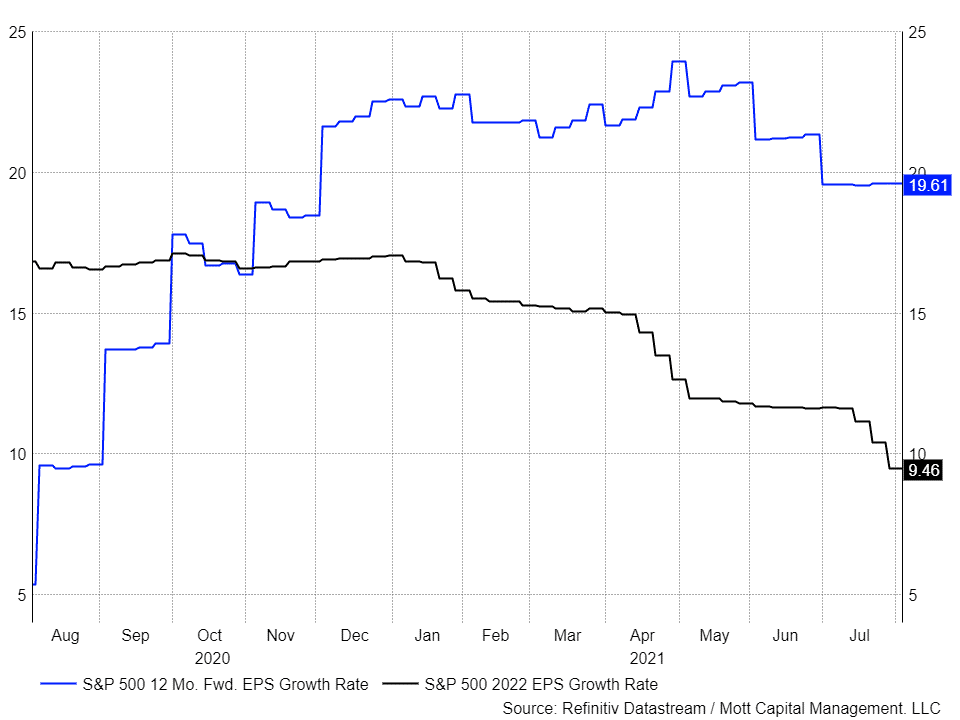

What has happened as this earnings season has moved forward is that much of the revisions to earnings have been front-end loaded, meaning they added a bump in estimates going towards 2021 and not beyond into 2022. Because of this, growth in 2022 is expected to slow dramatically, rising by just 9.5%. It also means that the 12-month forward earnings estimate will eventually reflect the 2022 EPS estimates of $213.35 per share, which would give the index a PE ratio of 20.7, just a touch lower than the current 12-month forward ratio.

It seems clear therefore that the solid second-quarter results have not helped enough to lift earnings estimates for 2022 in order to lower the valuation of the index. Unless revisions to 2022 earnings begin to get increased in a meaningful way, the index will be faced with a slowing earnings growth rate and a more hawkish Fed while trading at a peak PE ratio.

That could make things tricky for the S&P 500 as we move through the final four months of 2021, and investors begin to contemplate just how much they should be willing to pay for earnings. Higher growth rates deserve a higher PE, while lower growth rates deserver lower PE.

What Happens from Here

What needs to happen from here is to see earnings revisions continue to push higher at a much faster pace. To bring the PE multiple for 2022 back to pre-pandemic levels of around 17 and to maintain the current 4,400 level on the S&P 500, earnings for next year would need to climb to about $258 per share or $244 per share to trade at a PE ratio of 18. Both seem hard to achieve, considering earnings for 2022 would need to rise by at least 14% from current levels.

On the flip side, should earnings fail to advance, the S&P 500 value would need to fall by 12.7% for the PE ratio to contract to 18, or drop by 17.5% to fall to a PE of 17, or roughly 3,630 on the index.

Both scenarios appear to be extreme, but it tells us that despite an earnings season that was much better than expected, it was not good enough to help the market where it needed it the most.