This article was written exclusively for Investing.com

I last analyzed Citigroup (NYSE:) on Feb. 25, about 5.5 months ago. At that time, I settled on a bullish rating for C, although there were some factors that suggested caution.

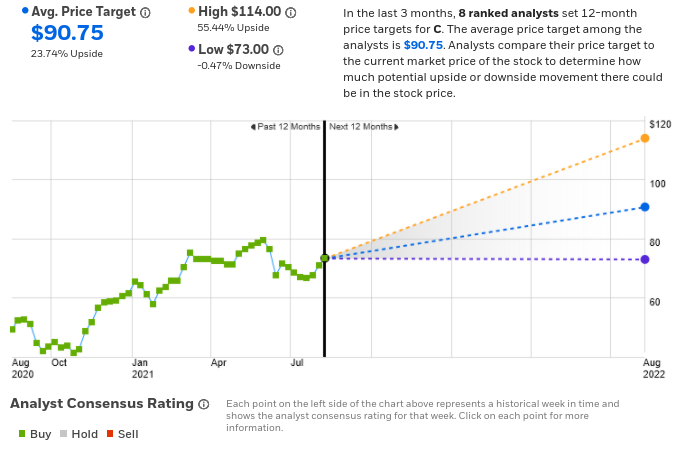

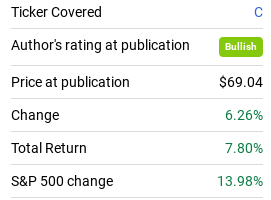

Since then, C has returned a total of 7.8%, as compared to a 13.98% gain for the . During this period, there have been , Q1 on Apr. 15 and Q2 on July 14, and EPS substantially beat the consensus estimates for both (by 39% for Q1 and 45% for Q2). In this post, I update my analysis and illustrate that the outlook for C is considerably better than in February.

C Performance vs SPX Since Feb. 25, 2021

Source: Seeking Alpha

Back in February, the forward P/E for C was 10.2 and the stock had the lowest P/E of any of the top ten holdings of the iShares U.S. Financials ETF (NYSE:). Today, the forward P/E for C is 7.47 and the trailing P/E is still the lowest among IYF’s top ten holdings.

The substantial decline in forward P/E, even as the share price has risen, shows that the earnings outlook has improved considerably since February.

Source: Seeking Alpha

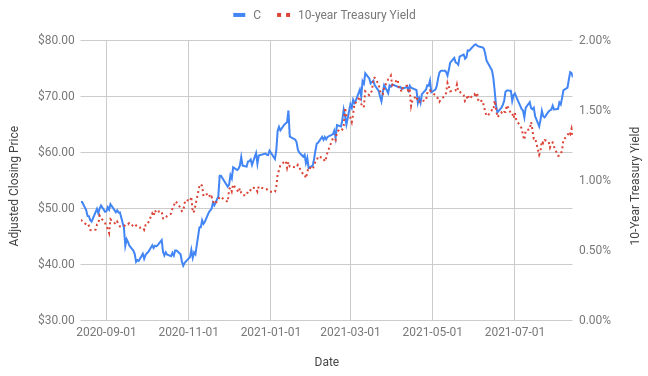

Bank stocks tend to exhibit a substantial positive correlation to interest rates and C is no exception. Over the past year, C has tracked the quite closely, for example (see chart below).

The expectation of rising rates is no small part of the bullish view for Citigroup. Inflation looks increasingly persistent, and bond yields have started to rise from July lows.

Adjusted closing price of C vs. 10-year Treasury yield

Data source: Yahoo! Finance

The outlook for Citigroup depends on company strategy as well as interest rates and the broader economy. Rather than building my own bottom-up analysis for C using my economic view, I rely on two forms of consensus outlooks.

The first is the well-known Wall Street analyst consensus. The consensus price target has been shown to have predictive value if the dispersion between the analysts is not too high.

The second form of consensus that I look at is the market-implied outlook which is derived from the prices of options on a stock. The market-implied outlook represents the consensus estimate of the probabilities of price returns reflected in options prices at a range of strike prices. For those who are not familiar with the concept of the market-implied outlook, I have written an overview that includes examples and links to the relevant finance literature. I have applied this technique in articles on a wide range of stocks.

Wall Street Analyst Consensus Outlook

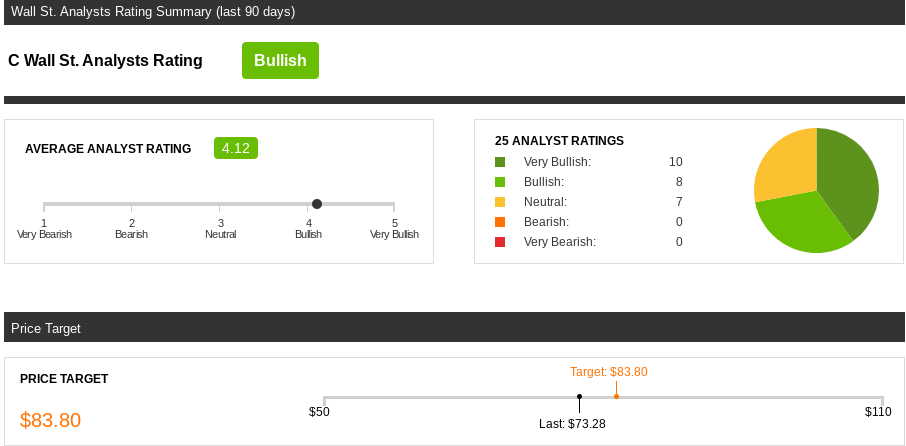

eTrade’s version of the Wall Street consensus combines the views of 8 ranked analysts who have set ratings and 12-month price targets for C within the past 90 days. The consensus rating continues to be bullish and the 12-month price target is $90.75, 23.7% above the current price.

The lowest of the analyst price targets is 0.47% below the current price. The highest price target, $114, matches the value from my past analysis, but the lowest price target, $73, is considerably higher than the previous low of $58.

Source: eTrade

Seeking Alpha’s Wall Street consensus includes ratings and price targets of 25 analysts who have established or updated their views in the past 90 days. The consensus rating is bullish and the price target is $83.80, 14.4% above the current price.

The substantial difference between Seeking Alpha’s and eTrade’s consensus outlooks is why I look at both. No analyst in the Seeking Alpha cohort gives C a bearish rating and 18 are either Bullish or Very Bullish.

Source: Seeking Alpha

The Wall Street consensus was also bullish in February, but the current price targets imply a substantially higher 12-month return than they did then. The expected 12-month price appreciation when I wrote my last analysis (link above) was in the range of 13.5% to 15.94%, as compared to 14.4% to $23.7% today.

Market-Implied Outlook

I have analyzed call and put options on C at a range of strike prices, all expiring on Jan. 21, 2022, to form the market-implied outlook for the next 5.3 months (from today until that expiration date). I analyzed the options with this expiration date because this period gives a view through the end of the year and because I analyzed the same option expiration in my previous analysis.

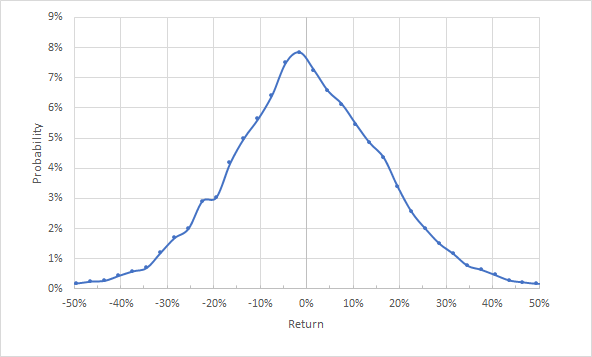

The standard presentation of the market-implied outlook is a probability distribution of price returns, with probability on the vertical axis and price return on the horizontal axis.

Market-implied price return probabilities for C

Chart timeframe: from today until Jan. 21, 2022 (Source: author’s calculations using options quotes from eTrade)

The market-implied outlook for C for the next 5.3 months is generally symmetric between positive and negative returns, although the peak probability is slightly tilted towards negative returns. The peak probability is at a price return of -1.6% and the median is -0.5%.

The annualized volatility derived from this distribution is 30%. The annualized volatility from my February analysis was 37%. The drop in volatility is consistent with the decline in market volatility since February.

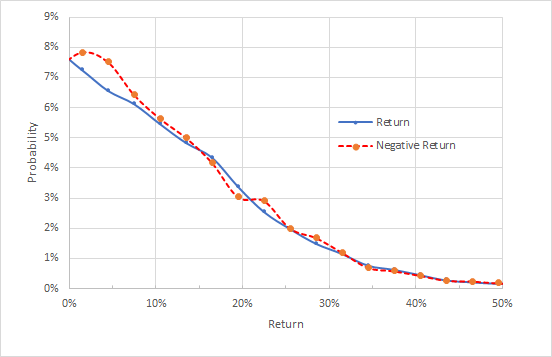

To make it easier to directly compare the relative probabilities of positive and negative price returns, I rotate the negative return side of the distribution about the vertical axis (see below).

Market-implied price return probabilities for C

Market-implied price return probabilities for C for the 5.3-month period from today until Jan. 21, 2022. The negative return side of the distribution has been rotated about the vertical axis (Source: author’s calculations using options quotes from eTrade)

The probabilities of positive and negative returns match almost perfectly (the red dashed line is on top of the solid blue line) except for the slightly elevated probabilities of negative returns around the peak of -1.6%. There should be two dividend payments between now and Jan. 21, 2022, totaling $1.02. The dividend income of 1.4% almost exactly offsets the -1.6% return corresponding to the peak probability.

Because investors tend to be risk averse (paying more than fair value for put options), this almost perfectly symmetric market-implied outlook corresponds to a somewhat bullish view from the options market.

The market-implied outlook for C is notably more bullish than in my last analysis, in which the market-implied probabilities of negative returns were markedly higher than for positive returns of the same magnitude. At that time, the Jan. 21, 2022 options had 11 months until expiration and the maximum probability corresponded to a price return of -10%.

Summary

In February, the Wall Street consensus outlook for C was bullish and the market-implied outlook was moderately bearish. Today, the Wall Street outlook is more bullish and the market-implied outlook has improved to be bullish.

The forward P/E has fallen because of rising earnings expectations. The expected volatility of C has declined, such that the return-to-risk outlook is improved further.

Financial stocks face considerable uncertainty with regard to interest rates, along with other economic and business risks. The increasingly bullish outlooks from both the analysts and the options market suggests that the expected upside justifies these risks. My overall outlook for C is bullish.