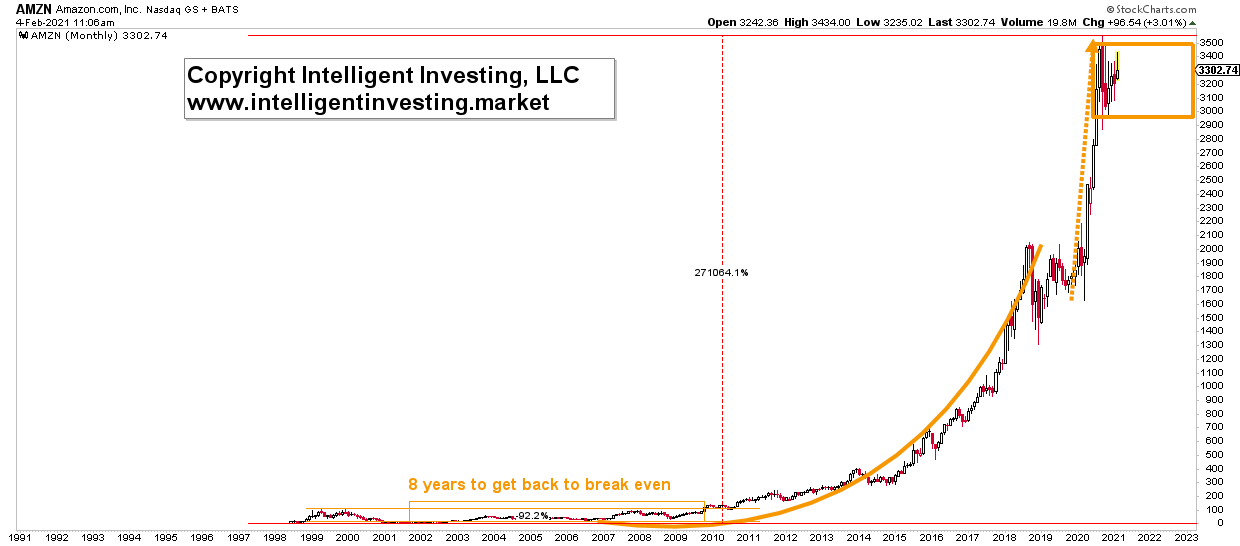

Since its IPO in 1998, Amazon.com Inc (NASDAQ:AMZN) has gained more than 27,100%. Let that sink in.

But was buy and hold the preferred strategy and without any scary ups and downs?

Not at all. Amazon had lost 95% of its value at the 2001 low. Let that also sink in.

It then took eight years to get back to break-even from its all-time High (ATH) made in 2000. Let that sink in, too. Thus, one had to sit through a terrifying time and wait many more years to get back to where things were. That is dead time and money.

Figure 1. Amazon monthly candlestick chart:

Amazon Monthly Chart.

Amazon Monthly Chart.

Ever since that low, gains have been indeed astronomical, and Amazon has had two parabolic phases. Can we expect the third one? Can we expect another 27,000% gain? Or, even another run of +100% like it experienced since March last year?

Most likely not. The Elliott Wave Principle count (see my previous article) suggests upside is minimal versus downside risk. The orange box shows a horizontal digestion zone for Amazon and a breakout targets ~$3800, while a breakdown would be long-term bearish and targets for starters $2,600. Because, please remember, if a stock has gone through a 95% correction, there is no reason to tell it will not do so again. How long will it then take to get back to break-even? Decades most likely.

Leave a comment